Nigeria is experiencing a surge in digital banking, joining a growing global trend. These new players are attracting customers with their user-friendly interfaces, low fees, and speedy online transactions. Their tech-savvy staff and focus on high-quality service make them a compelling alternative to traditional banks.

While digital banks might offer a narrower range of products compared to their established counterparts, they often specialise in services that cater more directly to customer needs. Despite offering similar core functionalities, these digital institutions fall under the umbrella of financial technology (fintech) companies in Nigeria.

The Central Bank of Nigeria (CBN) issues various licences to these fintech businesses, encompassing mobile money providers, payment service banks, lenders, and microfinance institutions. Notably, most of Nigeria's popular digital banks operate through mobile apps and hold microfinance banking licences.

In this article, we highlighted the 10 digital banks licensed by the CBN to operate as microfinance banks in Nigeria. Keep reading to find out more.

A Glimpse into the Digital and Micro-Banking Sector in Nigeria

The Central Bank of Nigeria (CBN) has greenlit ten new digital-only banks to offer microfinancial services. These virtual institutions, operating primarily through mobile apps, hold the same legal standing as traditional brick-and-mortar banks.

Nigeria's financial technology (fintech) sector is experiencing a surge, with companies leveraging cutting-edge technology to address the financial needs of the Nigerian population. To expand financial inclusion, the CBN has authorised digital payment platforms to provide microfinance banking and point-of-sale (PoS) services within the country.

These ubiquitous, yet virtual, digital banks have recently played a significant role in resolving financial challenges for Nigerians. While operating within the broader fintech ecosystem, they fulfil a similar function to traditional banks, albeit without a physical presence.

Fintech companies operate under various licences and offer a diverse range of services. They deliver these financial solutions through mobile apps and other digital touchpoints. As of February 2023, the CBN database lists approximately 894 licensed microfinance banks. However, only a select few fully digital institutions qualify as true digital banks.

The 10 Digital Banks Licensed by the CBN to Operate as Microfinance Banks in Nigeria

1. Sofri

Launched in April 2022, Sofri is a digital bank built for a mobile-first world. Backed by the established Links Microfinance Bank and licensed by the Central Bank of Nigeria (CBN), Sofri empowers you to manage your finances conveniently from your phone.

Think of Sofri as your all-in-one financial companion. Need to deposit a check, apply for a loan, or explore investment options? Sofri makes it easy, ditching the need for traditional bank visits. Their long-term vision? To become a nationwide microfinance bank, expanding financial access across Nigeria.

Sofri isn't just about convenience; it's also about innovation. They've been instrumental in helping Nigerians adapt to the cashless policy, even launching a lottery draw promotion campaign to incentivize digital transactions. Plus, Sofri is known for its lightning-fast transactions, making it a popular choice for those who value speed and efficiency.

2. Moniepoint

Moniepoint Microfinance Bank isn't your average bank. They're the go-to financial partner for over 600,000 Nigerian small and medium-sized businesses (SMBs).

Moniepoint understands the unique challenges faced by SMBs. That's why they offer a suite of simple and powerful business solutions, designed to streamline operations and fuel growth. Access loans, collect payments efficiently, and leverage valuable tools to manage your finances effectively – all through Moniepoint's user-friendly platform.

Their impact is undeniable. Moniepoint's solutions, encompassing Business Accounts, Point-of-Sale Terminals, and Expense Cards, have facilitated a staggering N7 trillion in monthly transactions for businesses on their platform.

Moniepoint goes beyond traditional banking. They operate as a Switch and Processor platform, connecting businesses with financial services. Additionally, they act as a microfinance bank, leveraging digital channels to expand financial opportunities for Nigerians nationwide.

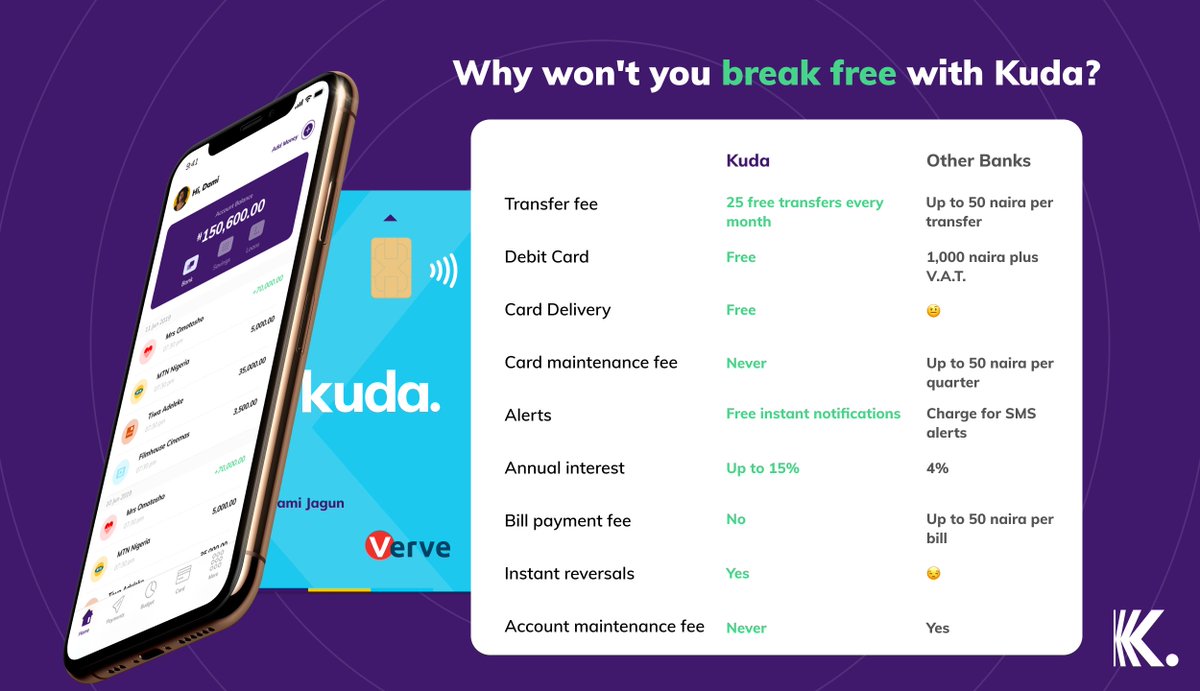

3. Kuda

Kuda isn't your typical bank. This Nigerian-focused, US$500 million fintech unicorn, approved by the Central Bank of Nigeria (CBN), brings a wave of innovation to your finances. Despite its international presence, Kuda remains dedicated to empowering Nigerians with a powerful mobile banking experience.

Say goodbye to monthly fees! Kuda offers a transparent and cost-effective banking solution. Manage your finances effortlessly with a Kuda account. Enjoy features like a debit card, spending limits, seamless money transfers, and a robust savings option.

Plus, Kuda empowers you with clear information on free transfer options, ensuring you get the most out of your money.

4. Sparkle

Launched in 2019, Sparkle Microfinance Bank isn't just another bank – it's your financial partner for life. Authorised by the Central Bank of Nigeria (CBN), Sparkle goes beyond traditional banking, aiming to simplify and improve your financial well-being.

Sparkle believes in empowering Nigerians. They offer a diverse range of solutions that cater to your professional and personal needs. Whether you're managing your finances, saving for a goal, or making everyday transactions, Sparkle is there to support you.

Their focus extends beyond banking; they take pride in helping you achieve your lifestyle goals.

5. Eyowo

Bill payment, direct deposit, and savings are all combined into one convenient digital microfinance bank called Eyowo, which has been approved by the CBN.

The bank provides its services to any Nigerian with a phone number in order to promote financial inclusion.

6. VFB

VFD Microfinance Bank provides modern, secure, and efficient financial services because of its streamlined digital and mobile platform. Through high-yield savings accounts and low-interest loans, the bank assists its clients in reaching their goals and overcoming temporary financial setbacks.

7. Carbon

Carbon is a digital bank with CBN authorization that provides investment options and a lending facility in addition to standard e-banking services like debit cards. Recharging mobile phones, making bill payments, and making person-to-person (P2P) payments are all possible with carbon accounts. also a microfinance organisation.

8. Mint

Mint, powered by the established Finex Microfinance Bank Ltd. and authorised by the CBN, is a digital bank designed to help you achieve your financial goals. Forget the limitations of traditional banking. Mint offers a suite of user-friendly financial tools to empower you.

Looking to save for a dream vacation or that perfect gadget? Mint's goal-based savings plans make it easy. Plus, you can earn a competitive interest rate of up to 36.5% on your savings, helping you grow your money faster.

Need some breathing room financially? Mint offers low-interest loans to bridge any temporary gaps. Additionally, their checking accounts are designed for everyday use, with no maintenance or transaction fees to worry about.

Mint goes beyond just baning; they provide you with the tools to manage your finances effectively. Their individual budgeting dashboard helps you track your spending and stay on top of your financial goals.

9. Piggy Vest

Operating under a microfinance bank licence issued by the Central Bank of Nigeria, Piggyvest is supported by the Nigeria Deposit Insurance Corporation (NDIC). PiggyVest is a service that assists consumers with investing and money management.

The company offers fixed and flexible, goal-oriented, automated savings plans as well as low-to medium-risk primary and secondary investment opportunities.

10. Fairmoney

FairMoney is a digital bank with a focus on lending. The company has also received approval from the CBN, a microfinance bank. A checking account and debit card are provided, along with instantaneous loans of up to one million naira. The organisation states that it distributes a loan every eight seconds and handles over 10,000 loans daily.