When you're trying to lower your monthly budget, there are certain items you cannot eliminate. Some of these you can’t even hope to reduce. Costs like rent are only likely to go up in future. However, not all monthly bills need to be fixed.

In particular, you might consider looking for savings for insurance. As an American, insurance plays an important part in your life. You need homeowners or renters insurance, life insurance, and health insurance.

If you don’t have term life insurance, you should consider getting it as soon as possible. This is particularly true for breadwinners, but applies even to those who are contributing in other ways, including child care and housekeeping. While you may want to save money on insurance, you should not do so by forgoing certain types of insurance entirely.

This is not to say you can’t save money on insurance. When it comes to health insurance, there are a number of ways to get better bang for your buck. Here’s how.

Compare Providers

Many people stay with their insurance provider without comparing whether other providers may be cheaper. This could be for a number of reasons, but one of the main ones is that health insurance can be confusing. Finding the right plan with your current provider may have been difficult enough. Switching to another can seem daunting.

But with online quotes, you don’t need to jump through hoops to find the cheapest provider. Of course, sometimes a cheaper provider does not offer as good a service, but in many cases, cheap providers are just as good or even better.

Raise Your Deductible

You can significantly lower your monthly premiums by raising your deductible. The question is whether it is worth it. There’s no simple answer to this, as it depends on circumstances.

Even if you are very healthy, an unexpected illness or injury could lead to huge healthcare bills. Don’t simply raise your deductible because you don’t expect to need health insurance. Rather, consider what you have available in savings. If you are able to afford to pay a higher deductible in a pinch, a lower premium may be well worth it.

This is especially true if you then save or invest what you would be spending on a higher premium. The time value of money [mfn]https://online.hbs.edu/blog/post/time-value-of-money[/mfn] should be a significant consideration in all of your financial decisions.

Pursue Wellness Rewards

Some health insurance providers will give you discounts or rewards if you meet certain fitness goals. These may include regular exercise, forms of wellness like yoga or stretching, as well as healthy eating. Insurers provide these discounts because you really are less likely to need health care if you take on these behaviors.

In other words, not only are you saving money on your premium, but you're also improving your health in a measurable way. These kinds of rewards are the best sort of incentives as it suits your insurer for you to be as healthy as possible.

Lower Your Healthcare Costs

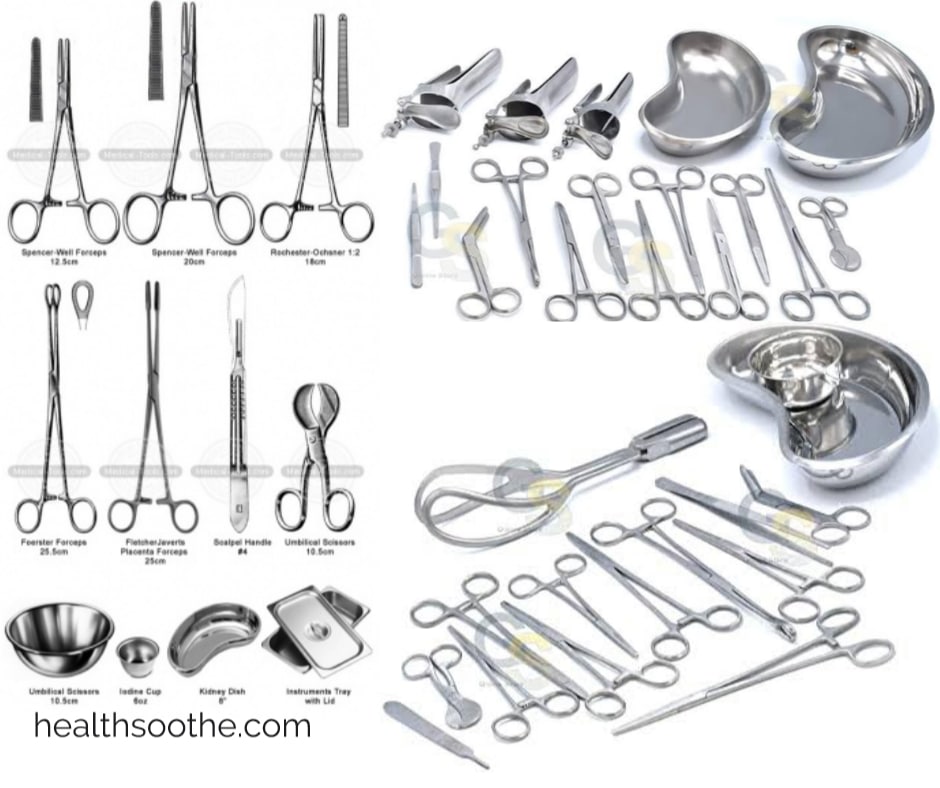

Ideally, you want to claim as little as possible from your insurance. This is not just to keep your claims history down, but it also helps you reduce the cost of copayments and out-of-pocket expenses. As such, you should try making the best decisions to keep your healthcare costs down.

One way to do this is by avoiding any unnecessary diagnostic tests. Unfortunately, many healthcare providers send you for tests that are not really necessary in order to pocket the money your insurer will pay. Always question why you need a test and turn down tests for which your doctor has only vague reasons.

Another way to lower healthcare costs is by buying generic versions of medication. These are exactly the same in terms of dose, safety, strength, and efficacy. Only the composition may differ, and the FDA has strict standards [mfn]https://www.fda.gov/drugs/frequently-asked-questions-popular-topics/generic-drugs-questions-answers[/mfn] ensuring the quality remains the same.

There is no reason you should be paying extra simply because of the brand name. You can save on claims, copays, and out-of-pocket expenses by choosing generics.

The above tips will help you save as much as possible on health insurance. There is no way of eliminating this expense entirely, but you can reduce the impact it has on your budget.