This post may contain affiliate links. Read our disclosure policy.

- So, What is the Meaning Of Capital Adequacy Ratio (CAR) As Defined By the Central Bank of Nigeria?

- Tier 1-Capital

- Tier 2-Capital

- Reasons why Capital Adequacy Ratio is Important

- The Takeaway

The Capital Adequacy Ratio (CAR) is a crucial financial metric used to assess the stability and health of banks and financial institutions. As defined by the Central Bank of Nigeria (CBN), CAR helps ensure that banks have enough capital to absorb potential losses, protecting depositors and maintaining overall financial stability.

This article delves into the meaning of Capital Adequacy Ratio (CAR), explaining its components, the formula used for its calculation, and its importance in the Nigerian banking sector. Understanding CAR is essential for stakeholders, investors, and anyone interested in the financial health of banks.

Read on to gain a comprehensive understanding of the meaning of Capital Adequacy Ratio (CAR) as defined by the Central Bank of Nigeria and its impact on the banking industry.

So, What is the Meaning Of Capital Adequacy Ratio (CAR) As Defined By the Central Bank of Nigeria?

How well a bank can meet its obligations is indicated by the capital adequacy ratio or CAR. The ratio also referred to as the capital-to-risk-weighted assets ratio (CRAR), is used by regulators to assess a bank's risk of failure by comparing capital to risk-weighted assets. It is employed to safeguard depositors and advance the global financial systems' efficiency and stability.

In this article, we will dive into the essentials of (CAR) capital adequacy ratio.

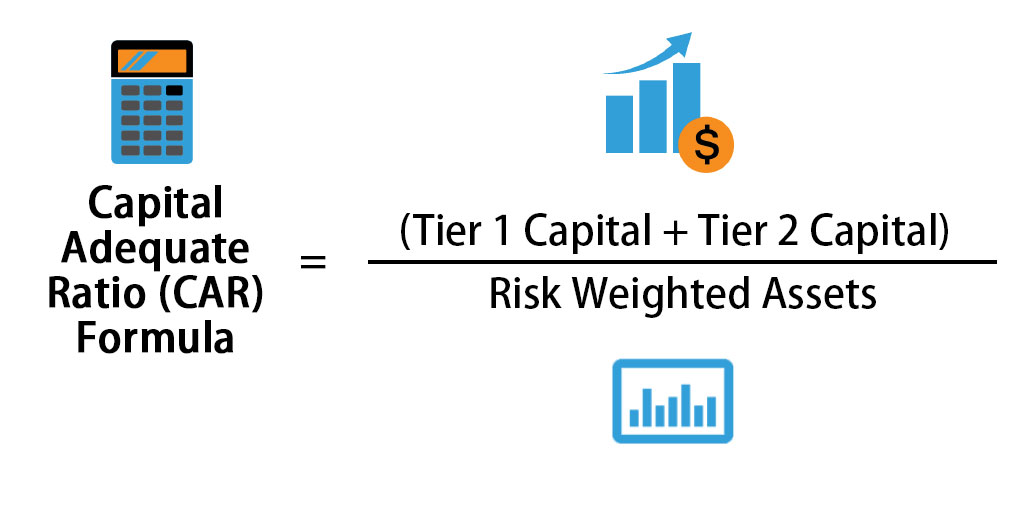

The capital of a bank is divided by its risk-weighted assets to get the capital adequacy ratio. The current Basel II and Basel III minimum capital-to-risk-weighted asset ratios are 8% and 10.5%, respectively, and contain a 2.5% conservation buffer. A high capital adequacy ratio exceeds Basel II and Basel III's minimal criteria.

- To make sure that banks have a sizable enough financial cushion to take on a fair amount of losses before going bankrupt, CAR is essential.

- Regulators utilize CAR to perform stress tests and assess banks' capital sufficiency. The CAR is measured using both tier 1 and tier 2 capital.

- Using CAR has the drawback of not accounting for the possibility of a bank run or what would occur in a financial crisis.

Two layers of capital are utilized to compute the capital adequacy ratio. The capital adequacy ratio of a bank is computed by multiplying the sum of the two capital tiers by risk-weighted assets.

By examining a bank's loans, assessing the risk, and then allocating a weight, risk-weighted assets are determined. A lender's balance sheet's asset value is adjusted to calculate credit exposures.

The lists below are of the two tiers that evaluate the capital adequacy ratio.

Tier 1-Capital

Equity capital, common share capital, intangible assets, and audited revenue reserves make up Tier-1 capital, also known as core capital. Tier-1 capital is the readily available capital that banks can always rely on to absorb losses and protect themselves without having to shut down.

Tier 2-Capital

Unaudited retained earnings, unaudited reserves, and general loss reserves make up Tier-2 capital. The capital that absorbs and softens losses if a bank is closing is known as Tier-2 capital. As a result, depositors and creditors are given less protection. When a bank exhausts its Tier-1 capital, it is used.

Reasons why Capital Adequacy Ratio is Important

Ratios of minimum capital adequacy are essential. They can show whether specific banks have sufficient capital to withstand a certain level of loss, preventing them from going bankrupt and losing depositor money.

In general, by reducing the likelihood of bank failure, capital adequacy ratios can contribute to the effectiveness and stability of a country's financial system.

In general, a bank that has a high capital adequacy ratio is thought to be reliable and safe to make its payments. Depositor funds are prioritized throughout the winding-up procedure over the bank's capital.

Depositors are therefore only in danger of losing their money if a bank experiences a loss greater than its capital. Therefore, the more the bank the higher the capital adequacy ratio, the better the assets of depositors are protected.