Navigating the world of loan apps in Nigeria can be challenging, especially with the plethora of options available. To help you make an informed decision, we've compiled a list of the top 10 loan apps in Nigeria by user ratings as of June 2024.

This list of the top 10 loan apps in Nigeria by user ratings as of June 2024 has been ranked based on user feedback, ensuring that you can choose from the best platforms offering quick approvals, competitive interest rates, and seamless user experiences.

Whether you need a personal loan, business funding, or emergency cash, these top-rated top 10 loan apps in Nigeria by user ratings as of June 2024 are designed to meet your financial needs efficiently and reliably.

Read on to discover which among our hand-picked list of the top 10 loan apps in Nigeria by user ratings as of June 2024 have earned the highest user ratings and why they stand out in the competitive loan market.

The Top 10 Loan Apps in Nigeria by User Ratings

1. Carbon (Rating: 4.8)

Formerly known as Paylater, Carbon remains a leading name in the Nigerian loan app market. Users praise Carbon for its seamless application process, instant loan approval, and transparency in interest rates. Additionally, Carbon offers services such as bill payments, airtime purchases, and a savings platform, making it a comprehensive financial tool.

Loan Highlights

- Loan amount: Tiered loan amounts based on eligibility.

- NGN30,000 to NGN200,000 (for new customers)

- Up to NGN600,000 (for qualified returning customers)

- Loan terms: Flexible repayment plans.

- Interest rates: Not mentioned publicly.

- Loan type: Personal loans.

- Eligibility: Minimum age of 18, BVN required, verifiable income.

User-Friendly Features

- USP: Easy and quick loan application process through their mobile app.

- Secure platform: Employs security measures to protect user data and privacy.

- Step-by-step guidance: In-app guidance throughout the loan application process.

Credibility and Trust Factors

- Licensed microfinance bank: Central Bank of Nigeria licensed.

- Positive user reviews: Over 3 million users rely on Carbon.

You can learn all you need to know about Carbon here.

2. Branch (Rating: 4.7)

The Branch APP motto is ‘Superior to your bank’, which seems a kind of over-the-top from an outside view. But on taking a closer look, with Branch, you can get fast loans up to ₦1,000,000, pay bills for free, transfer money, and take advantage of up to 23% investment income.

Branch simplifies financial services for Nigerians, offering easy money transfers, instant loans up to ₦1,000,000, and investment opportunities with yields of up to 10% and 15% per annum on Flexi Investments and Target Investments, respectively.

Branch is authorized by CBN, and it continues to be a favorite among users for its simplicity and reliability. The app provides loans without requiring collateral or complex paperwork. Users appreciate the flexible repayment terms and the app’s customer-centric approach, which includes 24/7 support and financial education resources.

Loan Highlights

- Loan amount: NGN1,000 to NGN1,000,000.

- Loan terms: Flexible repayment plans with terms ranging from a few weeks to 6 months.

- Interest rates: Competitive interest rates.

- Loan type: Personal loans, offers investment opportunities.

- Eligibility: Generally easy to qualify.

User-Friendly Features

- USP: All-in-one finance app with access to loans, savings, and investments.

- Convenient mobile app: Easy loan application, money transfers, and financial management.

- Secure platform: Uses advanced security measures to protect user data.

Credibility and Trust Factors

- Registered Microfinance Bank (MFB): Licensed by Nigerian authorities.

- Positive user reviews: Large user base with reviews available online.

To know more about Branch, click here.

3. FairMoney (Rating: 4.6)

FairMoney is a digital bank that simplifies loan applications, allowing you to receive funds directly into your bank account within minutes, available 24/7. FairMoney has garnered high ratings due to its fast loan disbursement and user-friendly interface.

The app requires minimal documentation and offers competitive interest rates. Users also benefit from its integration with major banks, ensuring a smooth repayment process..

Loan Highlights

- Loan amount: Not publicly specified.

- Loan terms: Flexible repayment plans with due dates.

- Interest rates: Transparent interest and fee charges.

- Loan type: Personal loans.

- Eligibility: Easy qualification process with BVN and minimal information required.

User-Friendly Features

- USP: Fast and convenient loan approval process through their mobile app.

- No paperwork required: Apply for loans without documents or collateral.

- Secure platform: Employs security measures to protect user data.

Credibility and Trust Factors

- Licensed lender: Operates in Lagos, Nigeria.

- Positive user Reviews: Large user base with reviews available online.

To know more about FairMoney, click here.

4. Renmoney (Rating: 4.5)

Renmoney’s reputation as a digital bank offering personal and business loans has earned it a high user rating. The app’s transparent terms, quick approval process, and additional banking services such as savings accounts and fixed deposits contribute to its popularity among users.

Loan App Highlights:

- Loan amount: NGN6,000 to NGN6,000,000.

- Loan terms: 3 - 24 months.

- Interest rates: Competitive interest rates.

- Loan type: Personal loans, Business loans.

- Eligibility: Employed, self-employed, business owners.

User-Friendly Features

- Unique Selling Point (USP): Access to quick loans, savings, and investments with competitive interest rates in one app.

- Easy Application Process: A simple and quick loan application process done through the app.

- Multiple Savings Option: Savings plans like Smart Goal and Save Easy.

Credibility and Trust Factors

- Licensed Microfinance Bank (MFB): Regulated by relevant authorities in Nigeria.

- Security: Use of best security and privacy standards to ensure data protection.

You can learn everything you want to know about Renmoney here.

5. Palmcredit (Rating: 4.4)

Palmcredit is known for its straightforward application process and immediate loan approval. Users rate the app highly for its flexible loan amounts and repayment schedules.

Loan Highlights

- Loan amount: NGN10,000 to NGN300,000.

- Loan terms: 91 days to 365 days.

- Interest rates: Transparent and competitive interest rates.

- Loan type: Personal loans.

- Eligibility: Simple eligibility requirements.

User-Friendly Features

- USP: Quick and easy loan application process with fast approvals.

- Mobile-first approach: Designed for a smooth mobile experience

- Flexible Repayment Options: Choose a repayment plan that fits your needs.

Credibility and Trust Factors

- Reputable lender: Committed to providing secure and reliable loan services

- Data privacy: Committed to protecting user data (

The app’s reliable customer support and easy navigation further enhance the user experience. Get the app here.

6. Aella Credit (Rating: 4.3)

Aella Credit offers a hassle-free loan application process tailored to both employed and self-employed individuals. Users commend the app for its low interest rates and flexible repayment plans. The app’s commitment to financial inclusion and education also resonates well with its user base.

Loan Highlights

- Loan amount: NGN1,000 to NGN1,000,000.

- Loan terms: Short-term loans with terms ranging from a few weeks to several months.

- Interest rates: Competitive rates based on your creditworthiness.

- Loan type: Personal loans.

- Eligibility: Transparent eligibility requirements are listed on their website.

User-Friendly Features

- USP: Emphasis on financial inclusion, offering loans to individuals who may not qualify for traditional bank loans.

- Minimal paperwork: Streamlined application process with minimal documentation required.

- 24/7 Customer Support: Available customer support to assist borrowers.

Credibility and Trust Factors

- Regulated lender: Operates under the regulations of Nigerian authorities.

- Secure platform: Uses advanced security measures to protect user data.

You can learn everything you want to know about Aella Credit here.

7. QuickCheck (Rating: 4.3)

QuickCheck leverages artificial intelligence to streamline the loan approval process. Users appreciate the app’s efficiency, competitive interest rates, and user-centric design. The financial tips and resources provided within the app are also valued by users aiming to improve their financial literacy.

Loan Highlights

- Loan amount: Focus on quick business loans from NGN1,500 to NGN500,000.

- Loan terms: Flexible monthly repayment plans ranging from 91 days to 1 year.

- Interest rates: Competitive interest rates starting from as low as 5% monthly on the first loan

- Loan type: Primarily business loans, may offer personal loans

- Eligibility: Businesses and potentially individual borrowers

User-Friendly Features

- USP: Instant access to business loans through their mobile app.

- Easy application process: Apply for loans in under 5 minutes.

- Secure platform: Use of secure technology for safe transactions.

Credibility and Trust Factors

- Licensed lender: Recognized as a legitimate lender in Nigeria.

- Positive user reviews: Well-rated on app stores.

You can learn everything you want to know about QuickCheck here.

8. Okash (Rating: 4.2)

As a subsidiary of Opay, Okash enjoys a strong reputation for its quick and reliable loan services. Users highlight the app’s high approval rates, the easy application process, and the convenience of accessing loans directly from their mobile devices without extensive paperwork.

Loan Highlights

- Loan amount: NGN3,000 to NGN700,000.

- Loan terms: Short-term loans with flexible repayment periods ranging from 91 days to 180 days.

- Interest rates: Transparent and competitive interest rates based on your creditworthiness.

- Loan type: Primarily offers Salary Advance loans.

- Eligibility: Minimum requirements, often focused on salaried individuals with verifiable income.

User-Friendly Features

- USP: Quick and easy access to salary advance loans through their mobile app.

- Simplified application process: Apply for loans in minutes with minimal paperwork.

- Disbursement speed: Potential for same-day loan approval and disbursement.

Credibility and Trust Factors

- Reputable lender: Part of a large financial group with experience in Nigeria.

- Secure platform: Employs security measures to protect user data.

You can learn everything you want to know about Okash here.

9. Migo (Rating: 4.2)

Migo, formerly known as Kwikmoney, integrates seamlessly with mobile networks and banks, allowing users to access credit effortlessly.

The app is praised for its innovative approach, ease of use, and the convenience it offers by not requiring a separate app download for loan applications.

Loan Highlights

- Loan amount: NGN5,000 to NGN100,000.

- Loan terms: Flexible repayment plans with terms ranging from 60 days to 1 year.

- Interest rates: Competitive interest rates are determined by an individual's credit profile.

- Loan type: Personal loans.

- Eligibility: Clear eligibility requirements are listed on their website.

User-Friendly Features

- USP: Promotes financial health through access to credit and educational resources.

- Step-by-step guidance: Offers in-app guidance throughout the loan application process.

- Loyalty program: Rewards program for consistent borrowers.

Credibility and Trust Factors

- Licensed microfinance bank: Operates under the regulations of Nigerian authorities.

- Secure platform: Uses advanced security measures to safeguard user data.

You can learn everything you want to know about Migo here.

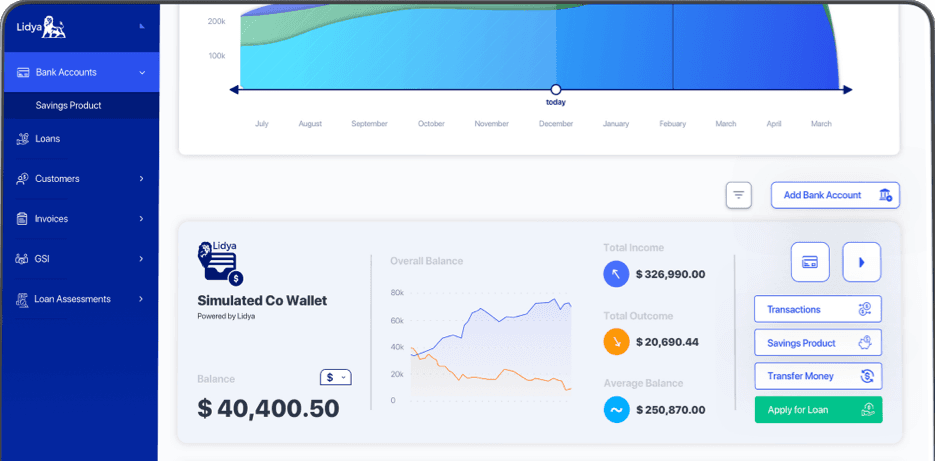

10. Lidya (Rating: 4.1)

Lidya specializes in providing loans to small and medium-sized enterprises (SMEs). The app’s high rating is attributed to its tailored financial solutions, detailed analytics, and risk assessment tools that help businesses secure the funding they need. Users appreciate Lidya’s commitment to supporting business growth and development.

Loan Highlights

- Loan amount: Not publicly specified on their website.

- Loan terms: Tailored loan terms designed to meet business needs.

- Interest rates: Competitive rates based on the business profile.

- Loan type: Primarily business loans.

- Eligibility: Businesses must register and provide required documents.

User-Friendly Features

- USP: Simplified loan application process designed for businesses.

- Online application: Apply for loans online through their platform.

- Dedicated customer support: Assists businesses with loan applications and inquiries.

Additional Business Services

- Lidya Collect: Payment collection platform to streamline business operations and manage cash flow.

- Integrates with existing payment gateways.

- Secure platform with industry certifications.

- Easy-to-use interface and customizable options.

Credibility and Trust Factors

- Licensed lender: Operates under Nigerian regulations.

- Positive user reviews: Reviews available online from satisfied businesses.

You can learn everything you want to know about Lidya here.

The Takeaway

In conclusion, the financial sector we have today in Nigeria is rapidly evolving, with numerous loan apps competing to offer the best services. Our list of the top 10 loan apps in Nigeria by user ratings as of June 2024 highlights the apps that have consistently provided excellent user experiences, quick loan disbursements, and favorable terms.

By choosing any of loan app from our list of the top 10 loan apps in Nigeria as of June 2024, you can ensure that your financial needs are met with the utmost efficiency and reliability.

Stay ahead of your financial challenges by leveraging the power of these top-rated top 10 loan apps in Nigeria by user ratings as of June 2024, and experience the convenience and support they offer. For the latest updates and detailed reviews, keep this guide handy and make informed decisions for your financial well-being.

I Am odudu abasi a top-notch and experienced freelance writer, virtual assistant, graphics designer and a computer techie who is adept in content writing, copywriting, article writing, academic writing, journal writing, blog posts, seminar presentations, SEO contents, proofreading, plagiarism/AI checking, editing webpage contents/write-ups and WordPress management.

My work mantra is: “I can, and I will”

The content is intended to augment, not replace, information provided by your clinician. It is not intended nor implied to be a substitute for professional medical advice. Reading this information does not create or replace a doctor-patient relationship or consultation. If required, please contact your doctor or other health care provider to assist you to interpret any of this information, or in applying the information to your individual needs.