Navigating the world of loan apps in Nigeria can be challenging, especially with the plethora of options available. To help you make an informed decision, we've compiled a list of the top 5 loan apps in Nigeria as of June 2024.

This list of the top 5 loan apps in Nigeria as of June 2024 has been ranked based on user feedback, ensuring that you can choose from the best platforms offering quick approvals, competitive interest rates, and seamless user experiences.

Whether you need a personal loan, business funding, or emergency cash, these top-rated top 5 loan apps in Nigeria as of June 2024 are designed to meet your financial needs efficiently and reliably.

Read on to discover which among our hand-picked list of the top 5 loan apps in Nigeria as of June 2024 have earned the highest user ratings and why they stand out in the competitive loan market.

The Top 5 Loan Apps in Nigeria

1. Carbon (Rating: 4.8)

Formerly known as Paylater, Carbon remains a leading name in the Nigerian loan app market. Users praise Carbon for its seamless application process, instant loan approval, and transparency in interest rates. Additionally, Carbon offers services such as bill payments, airtime purchases, and a savings platform, making it a comprehensive financial tool.

Loan Highlights

- Loan amount: Tiered loan amounts based on eligibility.

- NGN30,000 to NGN200,000 (for new customers)

- Up to NGN600,000 (for qualified returning customers)

- Loan terms: Flexible repayment plans.

- Interest rates: Not mentioned publicly.

- Loan type: Personal loans.

- Eligibility: Minimum age of 18, BVN required, verifiable income.

User-Friendly Features

- USP: Easy and quick loan application process through their mobile app.

- Secure platform: Employs security measures to protect user data and privacy.

- Step-by-step guidance: In-app guidance throughout the loan application process.

Credibility and Trust Factors

- Licensed microfinance bank: Central Bank of Nigeria licensed.

- Positive user reviews: Over 3 million users rely on Carbon.

You can learn all you need to know about Carbon here.

2. Branch (Rating: 4.7)

The Branch APP motto is ‘Superior to your bank’, which seems a kind of over-the-top from an outside view. But on taking a closer look, with Branch, you can get fast loans up to ₦1,000,000, pay bills for free, transfer money, and take advantage of up to 23% investment income.

Branch simplifies financial services for Nigerians, offering easy money transfers, instant loans up to ₦1,000,000, and investment opportunities with yields of up to 10% and 15% per annum on Flexi Investments and Target Investments, respectively.

Branch is authorized by CBN, and it continues to be a favorite among users for its simplicity and reliability. The app provides loans without requiring collateral or complex paperwork. Users appreciate the flexible repayment terms and the app’s customer-centric approach, which includes 24/7 support and financial education resources.

Loan Highlights

- Loan amount: NGN1,000 to NGN1,000,000.

- Loan terms: Flexible repayment plans with terms ranging from a few weeks to 6 months.

- Interest rates: Competitive interest rates.

- Loan type: Personal loans, offers investment opportunities.

- Eligibility: Generally easy to qualify.

User-Friendly Features

- USP: All-in-one finance app with access to loans, savings, and investments.

- Convenient mobile app: Easy loan application, money transfers, and financial management.

- Secure platform: Uses advanced security measures to protect user data.

Credibility and Trust Factors

- Registered Microfinance Bank (MFB): Licensed by Nigerian authorities.

- Positive user reviews: Large user base with reviews available online.

To know more about Branch, click here.

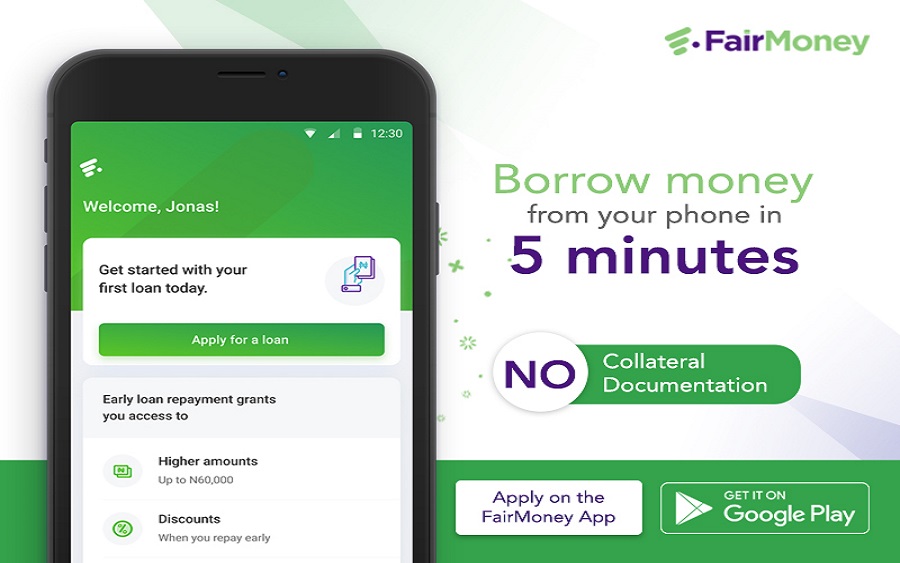

3. FairMoney (Rating: 4.6)

FairMoney is a digital bank that simplifies loan applications, allowing you to receive funds directly into your bank account within minutes, available 24/7. FairMoney has garnered high ratings due to its fast loan disbursement and user-friendly interface.

The app requires minimal documentation and offers competitive interest rates. Users also benefit from its integration with major banks, ensuring a smooth repayment process..

Loan Highlights

- Loan amount: Not publicly specified.

- Loan terms: Flexible repayment plans with due dates.

- Interest rates: Transparent interest and fee charges.

- Loan type: Personal loans.

- Eligibility: Easy qualification process with BVN and minimal information required.

User-Friendly Features

- USP: Fast and convenient loan approval process through their mobile app.

- No paperwork required: Apply for loans without documents or collateral.

- Secure platform: Employs security measures to protect user data.

Credibility and Trust Factors

- Licensed lender: Operates in Lagos, Nigeria.

- Positive user Reviews: Large user base with reviews available online.

To know more about FairMoney, click here.

4. Renmoney (Rating: 4.5)

Renmoney’s reputation as a digital bank offering personal and business loans has earned it a high user rating. The app’s transparent terms, quick approval process, and additional banking services such as savings accounts and fixed deposits contribute to its popularity among users.

Loan App Highlights:

- Loan amount: NGN6,000 to NGN6,000,000.

- Loan terms: 3 - 24 months.

- Interest rates: Competitive interest rates.

- Loan type: Personal loans, Business loans.

- Eligibility: Employed, self-employed, business owners.

User-Friendly Features

- Unique Selling Point (USP): Access to quick loans, savings, and investments with competitive interest rates in one app.

- Easy Application Process: A simple and quick loan application process done through the app.

- Multiple Savings Option: Savings plans like Smart Goal and Save Easy.

Credibility and Trust Factors

- Licensed Microfinance Bank (MFB): Regulated by relevant authorities in Nigeria.

- Security: Use of best security and privacy standards to ensure data protection.

You can learn everything you want to know about Renmoney here.

5. Palmcredit (Rating: 4.4)

Palmcredit is known for its straightforward application process and immediate loan approval. Users rate the app highly for its flexible loan amounts and repayment schedules.

Loan Highlights

- Loan amount: NGN10,000 to NGN300,000.

- Loan terms: 91 days to 365 days.

- Interest rates: Transparent and competitive interest rates.

- Loan type: Personal loans.

- Eligibility: Simple eligibility requirements.

User-Friendly Features

- USP: Quick and easy loan application process with fast approvals.

- Mobile-first approach: Designed for a smooth mobile experience

- Flexible Repayment Options: Choose a repayment plan that fits your needs.

Credibility and Trust Factors

- Reputable lender: Committed to providing secure and reliable loan services

- Data privacy: Committed to protecting user data (

The app’s reliable customer support and easy navigation further enhance the user experience. Get the app here.

The Takeaway

In conclusion, the financial sector we have today in Nigeria is rapidly evolving, with numerous loan apps competing to offer the best services. Our list of the top 5 loan apps in Nigeria as of June 2024 highlights the apps that have consistently provided excellent user experiences, quick loan disbursements, and favorable terms.

By choosing any of loan app from our list of the top 5 loan apps in Nigeria as of June 2024, you can ensure that your financial needs are met with the utmost efficiency and reliability.

Stay ahead of your financial challenges by leveraging the power of these top-rated top 5 loan apps in Nigeria as of June 2024, and experience the convenience and support they offer. For the latest updates and detailed reviews, keep this guide handy and make informed decisions for your financial well-being.